Interest rate swap in hedging variable rate debt with a swap an organization agrees to pay out a fixed amount each month to a counterparty in exchange for receipt of a variable rate.

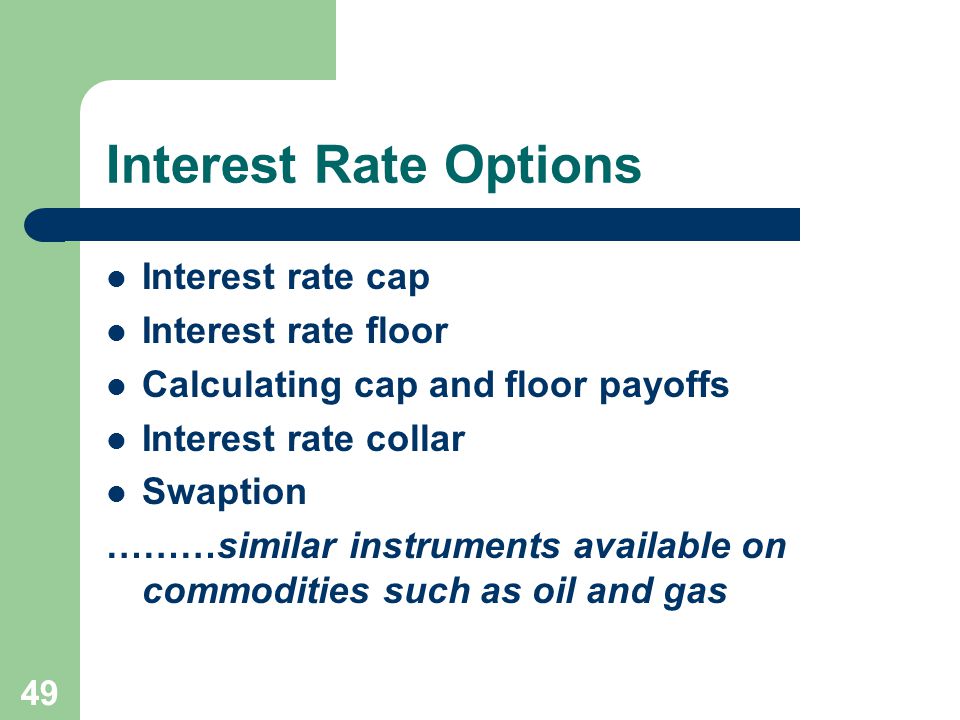

Cap floor collar options.

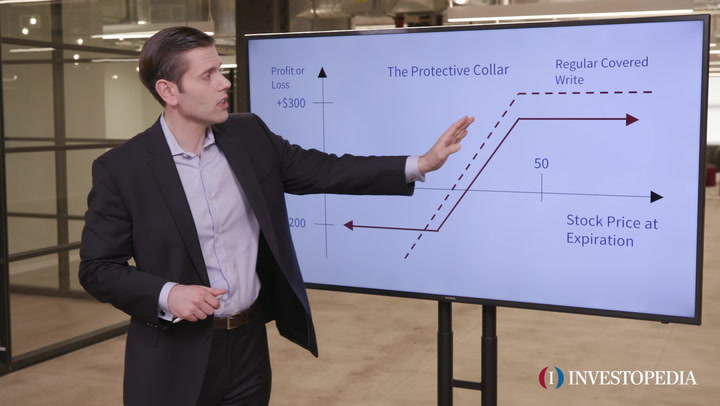

The puts and the calls are both out of the money options having the same expiration month and must be equal in number of contracts.

Or investor may buy a floor to avoid any future falls in the interest rates.

An option based strategy that is designed to establish a costless position and secure a return.

Caps floors and collars 1 caps floors and collars caps capped floaters inverse floaters with 0 floor floors floaters with floors collars floaters with collars strike rate settlement frequency index notional amount calls on yields puts on yields portfolio of options concepts and buzzwords reading.

These products are used by investors and borrowers alike to hedge against adverse interest rate movements.

Learn vocabulary terms and more with flashcards games and other study tools.

Caps floors and collars 2 interest rate caps a cap provides a guarantee to the issuer of a floating or variable rate note or adjustable rate mortgage that the coupon payment each period will be no higher than a certain amount.

Caps floors and collars are option based interest rate risk management products that put limits to the interest rates.

Establishing a floor and a cap on interest rates.

Cap floor and collar options on forex 03 03 2015 by forexderivatives bookmark the permalink.

A barrower may want to limit the interest rate to avoid any rises in the future and buys a cap.

In other words the.

An interest rate collar is an options strategy that limits one s interest rate risk exposure.

Cap is the whole list of options giving to the buyer opportunity to pay on the credit a market rate no more than an execution rate.

The call and put options take on the role of caps and floors.

It is a type of positive carry collar that is constructed by simultaneously purchasing and selling of out of the money calls and puts with the strike prices of which creating a band encircled by an upper and lower bound.

This organization has purchased a 5 cap and sold a 2 floor which provides the organization with an interest rate collar of 2 to 5.

Education general dictionary.

:max_bytes(150000):strip_icc()/dotdash_Final_Knock_In_Option_Apr_2020-01-ea2e95a4d5af4c96aa23b7c3e185f498.jpg)

:max_bytes(150000):strip_icc()/strategy-4086857_19201-23485cf7c4bf4dbbb95c93f267285f16.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Zero_Cost_Collar_Apr_2020-01-3f7ffff9ccd84d9e8f93fa3cd72c8d4f.jpg)

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

/cdn.vox-cdn.com/uploads/chorus_image/image/67106277/usa_today_11353321.0.jpg)

:max_bytes(150000):strip_icc()/stock-exchange-911608_1920-10d732f18b394e489f017932acd95d10.jpg)